Since 1890, all around the globe, we at Allianz have been working hard to secure people’s lives and to give courage to our customers for what’s ahead.

We are actuaries, advisors and service agents; engineers, lawyers and technology experts; we are daughters and sons, mothers and fathers, accountants, investors and entrepreneurs – and together we are shaping our industry.

Because we know how important it is to have a fair partner at your side who provides solid and sustainable solutions, we strive to do it right – with passion, every day.

Our aspiration is to be the trusted partner for protecting and growing your most valuable assets.

For assets we do not refer only to our customers' material asset, but also financial and human assets like health.

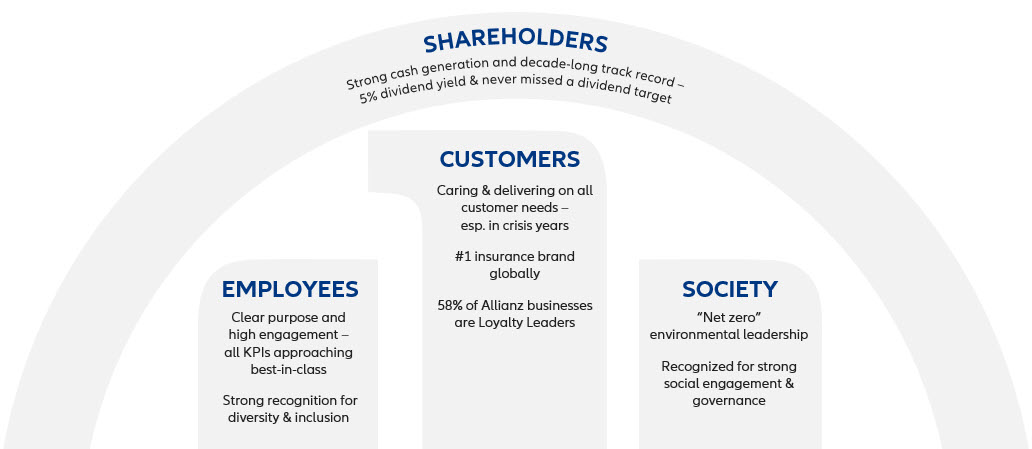

Our purpose and aspiration can only be achieved if we deliver on our three promises:

1. Careful balance across stakeholders

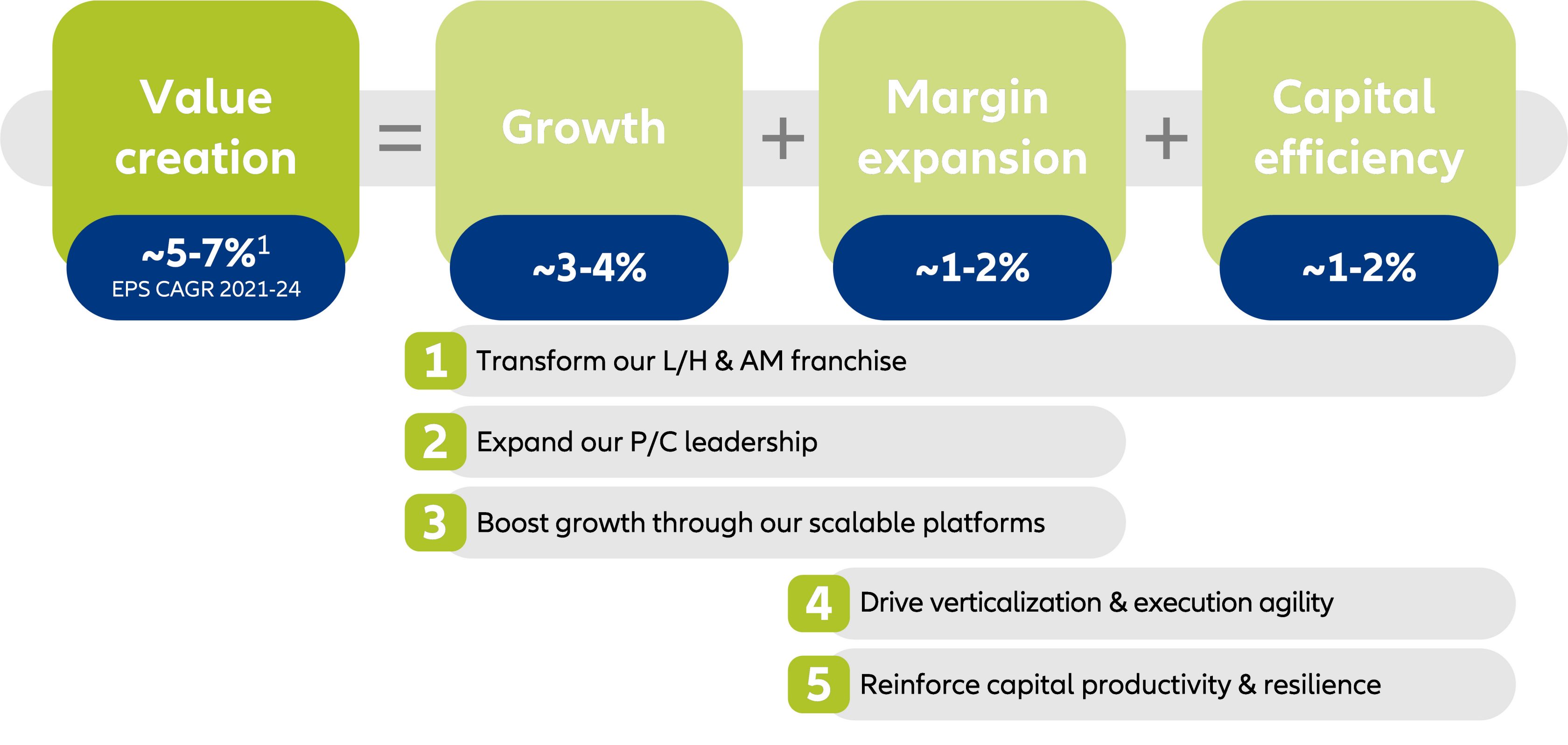

2. Delivery of benchmark results at scale

3. Strong resilience in a transforming world